Recently, the mainland-based CIS component factory Howell announced that the CIS chip was out of stock and the price rose by 10 to 20%. Prior to this, Samsung took the lead in issuing the CIS price increase notice, followed by Gekewei and BYD. This is not the first time that the price of CIS chips has been adjusted in the recent period of time. The "price surge" of CIS chips has come again, causing widespread concern in the industry.

Earlier, low-pixel CIS chips mainly based on 2M / 5M / VGA came out of the supply chain. The price adjustment mode was started. Later, the high- and low-pixel CIS chips were also pointed out as the production capacity became more tight, and the price of CIS chips ushered in a comprehensive rise.

Since November 2019, the price of CIS chips has been raised several times. According to the Securities Times e company news, the price increase trend of upstream and downstream manufacturers of CIS chips has risen simultaneously, with an increase of up to 20-40%.

The driving force for the rise in the price of CIS chips comes from the increase in demand for terminal cameras. From the perspective of the structure of the camera, it mainly includes a lens, a base, an infrared filter, an image sensor, a PCB, and an FPC. Among them, the two that have a greater impact on the imaging quality are the CIS chip and the lens.

The full name of CIS chip is CMOS image sensor, which is a device that converts optical images into electronic signals. It usually consists of image sensitive cell array, row driver, column driver, timing control logic, AD converter, data bus output interface, control interface and other parts, and these parts are integrated on the same silicon chip.

The increase in the number of cameras directly drives the demand for CIS chips. The three main application areas of cameras are automotive, security and mobile phones. With the development of automotive safety automation and smart security, the number of camera applications has gradually increased, within the foreseeable range, but the application of mobile phone cameras has surged in the past two years.

The number of Nokia 9 PureView front cameras released in the first half of 2019 has exceeded five. Based on this, plus 1-2 front cameras, the number of cameras on a smartphone is as high as 6-7. That's not counting the 3D camera. Some more niche mobile phone cameras have already exceeded nine.

Among the current mainstream mobile phones, even low-end mobile phones, rear dual cameras are already mainstream, equipped with 3-4 cameras has long become the basic configuration of mobile phones. Compared to 2017, the number of mobile phone cameras has doubled.

Demand skyrocketed, but the corresponding problem is that CMOS chip production capacity cannot keep up in the short term.

At present, among CMOS chip players, Sony, Samsung, and Howell's CIS market share is 42%, 18%, and 12% respectively, ranking first in the CIS market, and second in the group, ON Semiconductor (6%) and Panasonic (3%). ), Canon (3%), Hynix (3%), ST (3%), Gekewei (2%), Pixart (2%), Hamamatsu (1%), Pixelplus (1%).

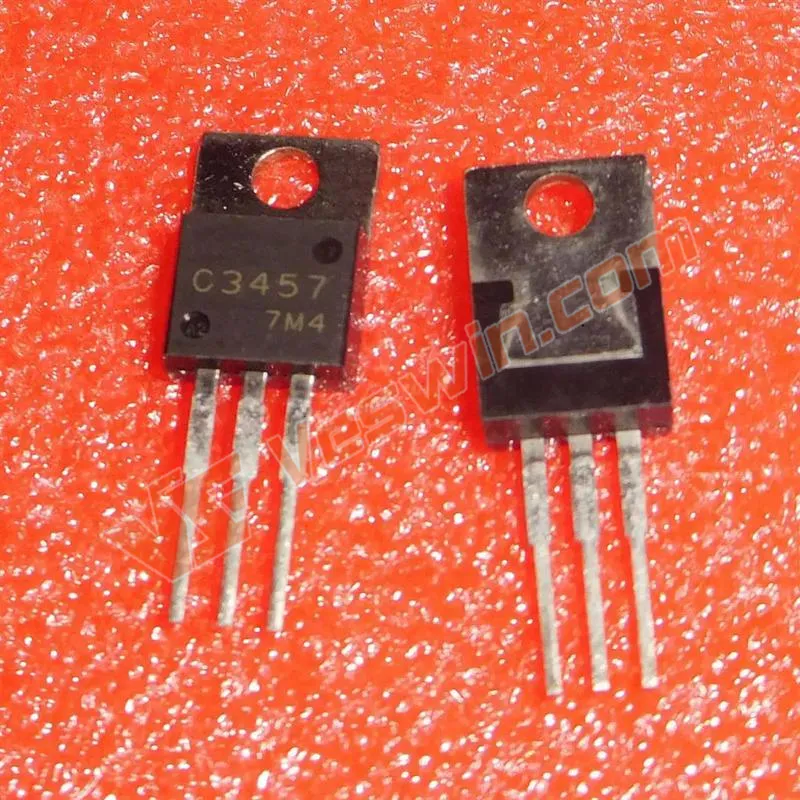

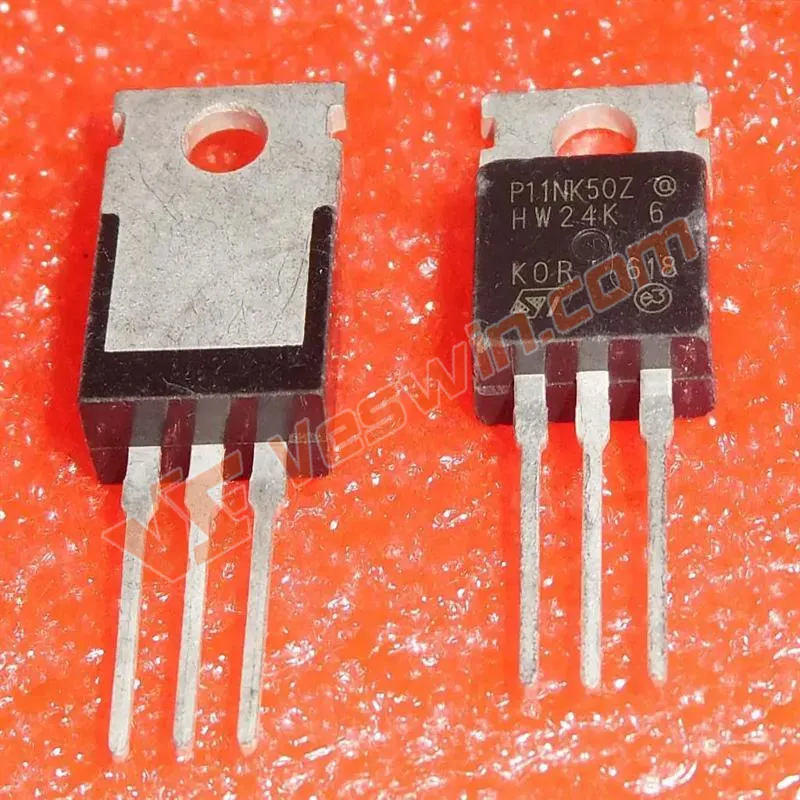

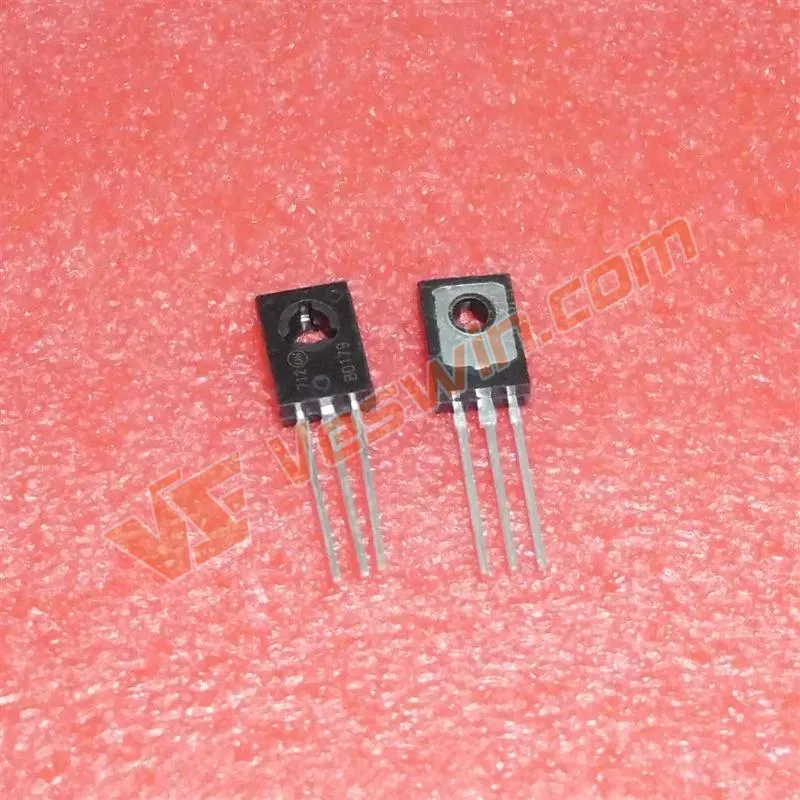

Among these mainstream CIS chip manufacturers, IDM mode (own wafer fab) is used by major manufacturers such as Samsung, Sony, ON Semiconductor, SK Hynix, and STMicroelectronics.

The third largest Howe adopts the Fabless (Fabless) model. The company does not have the ability to produce and process chips. The product production capacity is limited by the capacity allocation of the foundry. The current capacity of the foundry is not sufficient.

But even the IDM model currently does not have enough CIS chip capacity. According to Samsung, Samsung plans to convert two DRAM production lines to CIS chips in the second half of 2019. Previously, Samsung had only one CIS chip production line. Sony first revealed in November 2019 that the company will set up a new semiconductor factory at the Nagasaki Technology Center to increase CMOS chip production to meet market demand, and then announced that high-end CIS chips will be part of TSMC's foundry. Quarterly deliveries. TSMC's delivery date indicates that Sony's current production schedule for high-end CIS chips is still after 2021.

This also implies that, at least in high-end CIS chips, the state of tight production capacity may continue through 2020.

At the beginning of 2020, the prices of memory, video memory and flash memory began to rise. The prices of MLCC capacitors have also risen, and the prices of LCD panels have also risen. Now, the prices of CIS chips are also rising.

Some people in the industry have questioned: Does the "increasing" of electronic components mean that the "price increase" of electronic components will become the norm in 2020?

not necessarily. However, this means that after the electronic component market in 2019 is not as expected, after entering the new year, with the development of 5G, AI, Internet of Things and other technologies, the consumer market has restored some confidence in the electronic component market in 2020. From this perspective, it is not a bad thing even for terminal manufacturers who are the ultimate buyers of "price increases."

Hot News